Health Insurance

- Greetings

- Individual/Family Health Insurance

- Group Health Insurance

- Obamacare

- Medicare

- Insurance company Introduction

Health is your most important asset.

The secret to maintaining good health is moderate exercise and health management, and prevention of various diseases through periodic checkup.

Chun-Ha’s health insurance team makes every effort to provide you with the best possible plan through various health insurance products that will help you live a healthy life.

Most importantly, Chun-Ha’s high caliber service promises you the highest satisfaction through fast, accurate, and comfortable service.

Meet with our health insurance team today and learn about various health insurance products linked with skilled and competent medical staff.

Let us help you gain confidence in you and your family’s health.

John Park, SVP/Director

Direct: 714-590-3521 / Email: johnp@chunha.com

Individual/Family Health Insurance

Health is a precious asset. However, it needs to be accompanied by careful prevention and management, and appropriate treatment. The health plans offered by Chun-Ha Insurance are carefully tailored to meet each client’s specific needs. Chun-Ha’s agents are able to assist each client in diverse tasks such as enrollment and the filing of a claim.

In particular, our distinguished service for Korean clients who are not fluent in English ensures a certain measure of comfort to enrolled members.

It is now legally mandatory for everyone in the U.S. to have health insurance.

Health insurance with Chun-Ha Insurance is the best thing for you and your family’s health.

Ivy Yu, VP/Manager

Direct: 714-590-3537 / Email: ivy@chunha.com

Enrollment procedure for Individual/Family Insurance

Group Health Plan

If you are looking for a group health plan for your employees, consult with Chun-Ha Insurance.

With group health plans, management is as important as enrollment.

Based on years of experience and knowhow, Chun-Ha has been providing health insurance for countless businesses for the last 25 years, and its comprehensive service has been highly regarded by existing enrolled corporate clients.

The health insurance law is undergoing more changes than ever before. Chun-Ha boasts in its ability to receive legal advice through ISU’s Law Room which helps clients from getting hit with unexpected penalty bombs.

The experts at Chun-Ha Insurance promise to offer its clients’ businesses with more benefits and less financial burdens by staying up to date with the latest health laws.

Matthew Kim, FVP/Deputy Director

Direct: 714-590-3538 / Email: matthew.kim@chunha.com

Grace Lee, VP/Manager

Direct: 714-590-3532 / Email: grace.lee@chunha.com

Obamacare

Chun-Ha Insurance can assist you free of charge with health insurance enrollment that is now mandatory to everyone in the U.S.

The so called Obamacare (Patient Protection and Affordable Care Act), which is a federal law that was passed in 2010, was legislated in order to provide affordable health insurance to more Americans. You cannot be denied enrollment even if you have preexisting illness, and all Americans can receive health insurance benefits. If you fail to enroll in health insurance, a penalty is imposed, and the penalty amount is increasing every year.

Chun-Ha’s insurance experts assist clients free of charge with insurance enrollment through Covered California, which is California’s health insurance marketplace.

If you need to enroll in health insurance, please contact Chun-Ha Insurance and get free assistance.

Andrew Kim, VP/Manager

Direct: 714-390-3536 / Email: Andrew.kim@chunha.com

The website is owned and maintained by Chun-Ha Insurance Services, which is solely responsible for its content. This site is not maintained by or affiliated with Covered California, and Covered California bears no responsibility for its content. The e-mail addresses and telephone numbers that appear throughout this site belong to Chun-Ha Insurance Services and cannot be used to contact Covered California.

Example of Insurance Plan

| Silver 87 | |||

| Deductible | $500 | X-Ray copay | $20 |

| Preventive care copay | $0 | Emergency room copay | $75 |

| Regular care copay | $15 | Admission/Surgery | 15% |

| Expert care copay | $20 | Brand-name drug prescription copay | $15 |

| Urgent care copay | $30 | Max. out-of-pocket per individual | $2,250 |

| Generic drug prescription copay | $5 | Max. out-of-pocket per family | $4,500 |

| Lab exam copay | $15 | ||

| Deductible (Orange County) | ||||

| Total members of household | Age | Annual Income $50,000 | Annual Income $65,000 | Annual Income $75,000 |

| 4 | 25 | $227 | $289 | $506 |

| 4 | 35 | $217 | $378 | $495 |

| 4 | 44 | $203 | $366 | $483 |

| 4 | 55 | $161 | $324 | $441 |

| Deductible (Los Angeles County) | ||||

| Total members of household | Age | Annual Income $50,000 | Annual Income $65,000 | Annual Income $75,000 |

| 4 | 25 | $253 | $432 | $549 |

| 4 | 35 | $247 | $426 | $543 |

| 4 | 44 | $241 | $420 | $537 |

| 4 | 55 | $219 | $398 |

$515 |

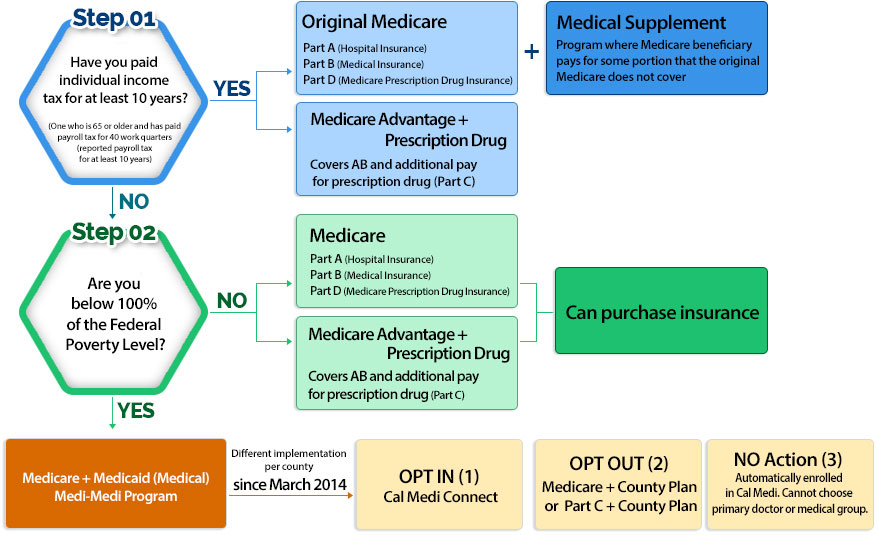

Medicare

Chun-Ha Insurance is able to answer any questions regarding Medicare.

Medicare, operated through federal social security taxes, is medical insurance for people aged 65 and over, along with patients requiring kidney dialysis or treatment for Lou Gehrig’s disease. As for the benefits, there are inpatient and outpatient treatments and access to special prescription drugs.

It is recommended that you prepare approximately 6 months prior to turning 65 years of age. In order to properly enroll in Medicare, it is important to understand the benefits you need, and the medication you need to take.

Consulting with Chun-Ha Insurance’s Medicare expert will help you to receive the proper benefits you are entitled to.

Ivy Yu, VP/Manager

Direct: 714-590-3537 / Email: ivy@chunha.com

Did you turn 65?

Insurance company Introduction

Life Insurance/Retirement Plan

- Greetings

- Life insurance

- Retirement pension

- Long Term Care

- Student loan insurance

- Insurance company introduction

If you are looking for something to do for you and your family today, we recommend enrolling in life insurance.

Life insurance is a true gift of love that can relieve your remaining family from their financial hardships and burden when faced with an unexpected death.

Life insurance is also a wise investment for the future since it can be used for various purposes such as a retirement plan.

Tae Hwan Jung, SVP/Director

Direct: 714-590-3502 / Email: tae@chunha.com

Life insurance

Life insurance is a gift for your family.

If a person passes away due to an unfortunate accident, the remaining family, such as the spouse and children can face financially devastating situations.

However, life insurance can help the family overcome such crises and be used as tremendous support in getting back on their feet.

Also, depending on how it is designed, life insurance can be used as an important means for you to maintain financial independence without relying on your children after retirement.

With years of experience and knowhow, Chun-Ha Insurance will find the best available insurance product based on the client’s circumstances and needs.

Life insurance is love for the family.

Tae Hwan Jung, SVP/Director

Direct: 714-590-3502 / Email: tae@chunha.com

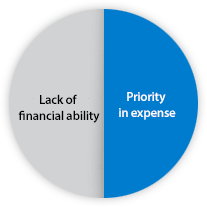

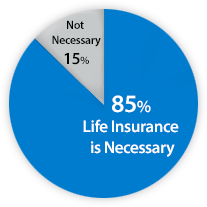

Facts about life insurance

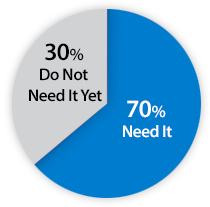

- The two biggest reasons people do not enroll in life insurance

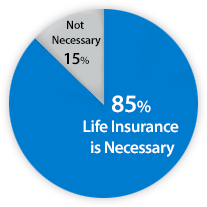

- 85% of Americans believe life insurance is necessary.

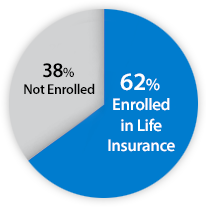

- Only 62% of the people who responded that life insurance is necessary are actually enrolled in life insurance

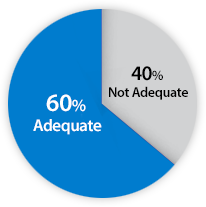

- 40% of the people who are enrolled in life insurance do not believe that it is adequate.

Retirement insurance

Retirement is the beginning to a new life.

If you are dreaming of a comfortable retirement livelihood, setting up a retirement plan is a wise move. This is especially true if you do not wish to rely on unstable social security checks. However, you have to begin immediately. When it comes to saving for your retirement, time is of the essence.

Meet with the experts at Chun-Ha insurance and discuss various retirement financial products such as the 401k and pension plan to establish the most effective financial plan for you. You will be able to enjoy an enriched retired life.

Tae Hwan Jung, SVP/Director

Direct: 714-590-3502 / Email: tae@chunha.com

The reason for retirement pensions

-

01. The depletion of social security

- According to a 2005 report by the Social Security Administration, while 159 working population were in charge of one person’s social security in 1940, in 2003, 3.3 working population paid for one person’s pension benefits, and this trend is getting worse and worse.

-

02. The worsening of inflation

- For example, if you earn a profit at an annual rate of 6% through investing $100,000 for 25 years, this is less than the average inflation rate of 7%. Furthermore, if you deduct tax from the 6% profit, this is far less than the inflation.

-

03. Medical expense

- The depletion of the social security administration’s social security fund does not only affect pension benefits, but also the health insurance benefits for future Medicare/Medicaid recipients. This can lead to additional financial burden in medical expenses after retirement.

Long Term Care

You can receive nursing service without the help from people around you.

With Long Term Care (LTC), you may need nursing home or nursing service when you become old and impaired in mobility, or cannot take care of yourself due to chronic illness or disability.

Many people think that all long term care can be resolved through Medicare or Medicaid but in reality, Medicare’s benefit only lasts up to 100 days, and Medicaid is for people with low income, therefore you won’t get the benefits unless you qualify.

Chun-Ha Insurance provides insurance benefits to clients with various insurance programs that are not only long term care insurance but also life insurance with long term care benefits. By making long-term plans for your post-retirement life ahead of time, you can relieve you and your family’s burden and hardship.

Tae Hwan Jung, SVP/Director

Direct: 714-590-3502 / Email: tae@chunha.com

The Necessity of Long Term Care insurance

- - Percentage of people over age 65 that need a caretaker

- - Percentage of people over age 85 that need a caretaker

- -Percentage of people (during the period between post-retirement and death) that need a caretaker

| Taking baths | Wearing clothes | Using the toilet | Moving within the house | Eating |

If a person has difficulty doing any of the 5 above activities within the house, the person needs long term care or the assistance of a caretaker.

Student loan insurance

Every year, several thousand dollars of college tuition payments impose a severe burden on households.

For middle class or above families, it is difficult to obtain the financial support opportunities offered by colleges.

If you want your children to focus solely on their studies at a college of their choice, you need to prepare a college fund plan for them starting now.

With Chun-Ha Insurance providing you with detailed explanations about student loan insurance, you can be prepared.

Today’s encounter with Chun-Ha Insurance will be tomorrow’s great gift for your children.

Young Noh Lee, LA Branch Office Manager

Direct: 213-375.3660 / Email: young@chunha.com

2014-2015 increase in tuition

|

Public 2 Year In-District |

Public 4 Year In-State |

Public 4 Year Out of State |

Public 4 Year Non-Profit |

|

| Tuition and Fees | ||||

| 2014-2015 | $3,347 | $9,139 | $22,958 | $31,231 |

| 2013-2014 | $3,241 | $8,885 | $22,223 | $30,131 |

| $ Change | $ 106 | $ 254 | $ 735 | $190 |

| % Change | 3.3% | 2.9% | 3.3% | 1.3% |

| Room and Board | ||||

| 2014-2015 | $7,705 | $9,804 | $9,804 | $11,188 |

| 2013-2014 | $7,540 | $9,498 | $9,498 | $10,824 |

| $ Change | $ 165 | $ 306 | $ 306 | $364 |

| % Change | 2.2% | 3.2% | 3.2% | 3.4% |

| Total | ||||

| 2014-2015 | $11,052 | $18,943 | $32,762 | $42,419 |

| 2013-2014 | $10,781 | $18,383 | $31,721 | $40,955 |

| $ Change | $ 271 | $ 560 | $ 1,041 | $1,464 |

| % Change | 2.5% | 3.0% | 3.3% | 3.6% |

- College tuition is increasing every year, and other general costs, such as rent and books, are also increasing at an average rate of 3.1%.

Insurance company introduction

Chun-Ha Insurance provides the best insurance products to its clients by carefully selecting the most reliable insurance carriers based on its 25 years of experience and expertise.

Auto/Home Insurance

Chun-Ha Insurance can protect your valuable assets.

By law, you need to have auto insurance in order to protect yourself and others.

Many drivers have regrets later on regarding their auto insurance due to not clearly understanding the policy they enrolled in. Insurance with cheap insurance fees is not necessarily a good investment. Purchasing a proper and adequate insurance product is a wise and frugal thing to do.

It is also important to get help from experts in finding the best home insurance product with proper benefits for your family’s valuable homes and apartments. Chun-Ha’s auto/home insurance team can offer you reasonable insurance premiums, along with the best possible coverage, and outstanding service to make you feel at ease.

Joe Im, EVP/CPO

Direct: 714-590-3515 / Email: joe@chunha.com

Auto insurance

We offer you economical insurance premiums along with the best coverages and services.

We provide affordable insurance fees with upgraded coverage and various special provisions through more than 20 major insurance carriers with excellent ratings on customer satisfaction. Also, at time of renewal, we offer you the most affordable and competitive insurance products by comparing the prices of many insurance carriers, and at the time of an accident, we can help you get complete and proper compensation based on your insurance.

Michael Lee, FVP/Deputy Director

Direct: 714-590-3517 / Email: mike@chunha.com

You might qualify for the following discount programs:

|

Good Student Discount Full time student with above 3.0 GPA |

Student Away at School Discount A student residing nearby college over 100 miles from home |

|

Additional Good Driver Discount No violations or accidents in the last 5 years |

Group Discount Variety occupations including business owners and 4 years college alumni |

|

Loan / Lease Gap Covers up to 25% of the actual cash value of the vehicle in case of total loss |

OEM Replace damaged property with new original equipment manufactured parts (if available) |

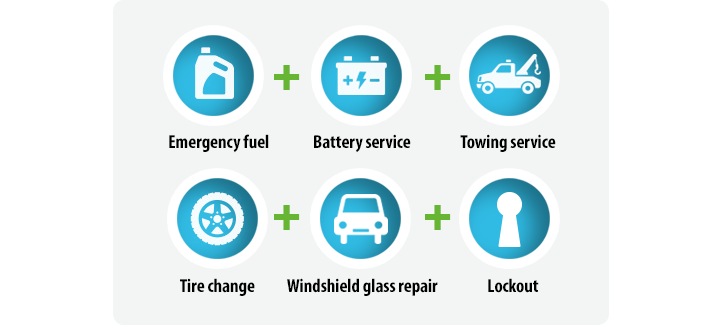

You can receive the following services pursuant to the contract provisions:

Home insurance

Is your precious home safe from all kinds of danger?

The home insurance for your precious residential real estate has a wide range of insurance products and coverage depending on the type of property, and therefore, it is imperative to receive proper assistance from an expert.

Chun-Ha’s home insurance team promises to assist you in receiving the proper compensation and benefits you deserve in times of trouble.

Also, we provide our distinguished services from our client’s perspective, taking into account not only the best insurance products but also various discount programs. With Chun-Ha on your side, you will be provided with clear and detailed explanations of various products and an insurance best suited for your current home which will finally make you feel secure.

Karen Chung, FVP/Deputy Director

Direct: 714-590-3516 / Email: karen@chunha.com

You might qualify for the following discount programs-

| Gated Community Discount |

Martial Status Discount For married couple |

|

Age of Insured Discount Discount percentage varies depend on the age |

Age of Home Discount For newer homes up to 10 years |

|

Home Purchase Discount For newly purchasing client regardless age of home |

If you enroll in both the home insurance and auto insurance at the same time, you can enjoy up to 25% discount in insurance premium.

Insurance company introduction

Chun-Ha Insurance provides the best insurance products to its clients by carefully selecting the most reliable insurance carriers based on 25 years of experience and expertise.

Business Insurance

- Greetings

- Business insurance

- Workers’ Compensation

- Additional commercial insurance

- Insurance company introduction

Chun-Ha can protect your precious business..

There are so many factors that can threaten your business, which you worked so hard to establish and grow.

If you are looking for an insurance company that will protect your business from all kinds of danger and promptly assist you in the event of accidents and trouble, Chun-Ha’s business insurance team should be your definite choice.

Our business insurance team, which consists of experts with many years of experience, will be your faithful partner in helping you build a custom fit insurance plan for your business.

Our business insurance team is with you to help your business succeed.

Kenny Yoon, SVP/Director

Direct: 714-590-3511

Business insurance

Chun-Ha Insurance can protect your precious business from all kinds of danger.

Liability insurance and property insurance are necessary in protecting your business. Chun-Ha Insurance, a member of ISU Group which is the second largest insurance broker federation in the U.S., offers the perfect insurance for your specific business type through more than 350 major insurance carriers. Also, in case of a lawsuit, the insurance carrier’s legal department will provide legal representation on behalf of the client.

Chun-Ha Insurance will assist you in effectively managing potential risks in the workplace.

Justin Kim, FVP/Deputy Director

Direct: 714-590-3541

The strength of Chun-Ha Business Insurance

- 01.Chun-Ha’s Business Insurance team consists of qualified experts such as Certified Insurance Counselors (CIC), and Certified Insurance Sales Representatives CISR), who can provide distinguished expertise, management and service that surpass that of other insurance companies.

- 02.Chun-Ha’s business insurance team possesses more than 350 major insurance carrier’s insurance products through the ISU network so we guarantee the utmost satisfaction through outstanding service and best available insurance premium.

- 03.Under the belief that our client’s success is what makes our success, we do our best to provide accurate and expedient service.

Workers’ Compensation

An accident-free workplace is every business owner’s constant goal. However, despite efforts to prevent accidents, employee injuries caused by unexpected circumstances put business owners in a difficult situation.

Chun-Ha Insurance is actively involved in making safe workplace environments through loss control programs intended for accident prevention and provides the most suitable workers’ compensation products based on the business’ size and unique characteristics. In the case of an accident, we provide our clients with convenient services from claim filing to compensation and offer legal assistance through major insurance carriers.

Before enrolling in legally mandated workers’ compensation, meet with Chun-Ha Insurance to learn about the best insurance for your business so that you can operate your business worry free.

Ju Lie Kim, FVP/Director

Direct: 714-590-3504

Chun-Ha Insurance’s Loss Control Program

- Preventing employee workplace injuries, along with damages to your company’s buildings or equipment, is important in operating a safe and competitive business. By setting a goal and taking systematic steps, these accidents can be prevented.

|

|

|

|

|

|

1. Analysis of potential risk 2. Safety training 3. Quarterly safety examination and analysis 4. Quarterly manager meeting 5. Annual report |

1. Inspection and testing 2. Safety training 3. Injury, illness, and accident assessment 4. Employee survey 5. Sanitation evaluation |

1. Removal and replacement of risk 2. Risk notification 3. Administrative action and safety equipment supply |

In case of worker injury, proper first aid action can prevent further harm. Learning strategies for emergency and injury situation are important. | In the case of an accident, immediate reporting is crucial. Promptly examining and comprehending the cause can help prevent future accidents. |

|

|

|

|

|

| Loss Control Programs continuously provide all staff with workplace safety training. | Communication among departments and staff is important. Understanding the risk factors helps to prevent injuries and accidents from happening beforehand. | Periodic examination and revision of defective elements help to effectively prevent future damages. | Keeping written reports of all workplace injuries and accidents help make a safer workplace by enabling the revision of loss control programs where needed. |

Additional commercial insurance

Even with liability insurance, business property insurance, and workers’ compensation, there are additional insurance products that you might need based on your business’ specific requirements.

Example)

If you are faced with lawsuits relating to workplace sexual harassment, wrongful termination, or discrimination, you can be protected through employment practice liability, and if the lawsuit exceeds your existing insurance coverage, you can benefit by having Umbrella Liability insurance.

Noah Chun, VP/Manager

Direct: 714-590-3514 / Email: noah@chunha.com

Additional Commercial Insurance

| Employment Practice Liability | Umbrella Liability |

| Business Umbrella Liability | Directors and Officers Liability Insurance |

| Foreign Liability | Crime Policy |

| Fiduciary Liability | Intellectual Property |

Insurance company introduction